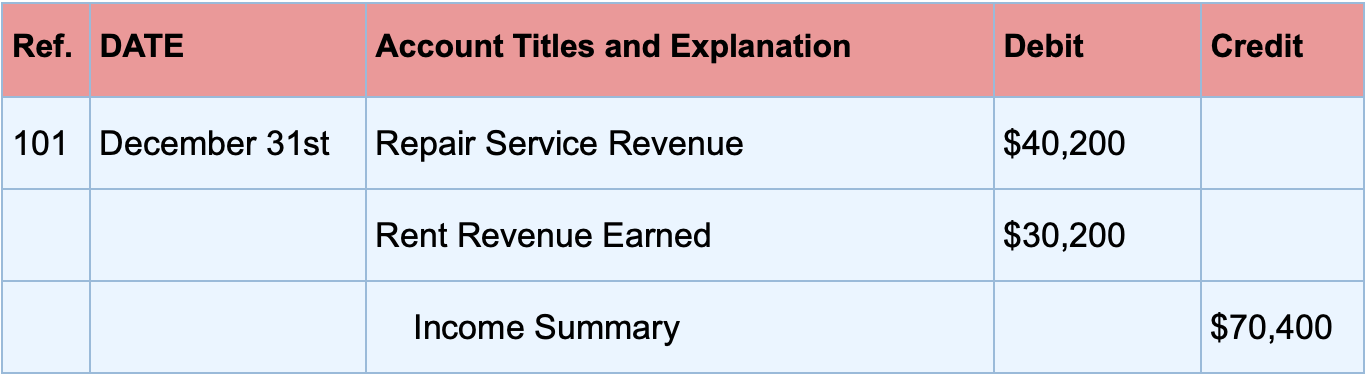

Notice that revenues, expenses, dividends, and income summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle. The first entry requires revenue accounts close to the IncomeSummary account. Closing entries are performed after adjusting entries in the accounting cycle. Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period.

Closing Entry in Accounting: Definition and Best Practices

- Creating closing entries is one of the last steps of the accounting cycle.

- Closing entries are performed after adjusting entries in the accounting cycle.

- These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings.

- To add something to Retained Earnings, which is an equity account with a normal credit balance, we would credit the account.

One of your responsibilities is creating closing entries at the end of each accounting period. ‘Retained earnings‘ account is credited to record the closing entry for income summary. Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings.

Do you own a business?

We want income statements to start every year from zero, but for accounts like equipment, debt, and cash accounts—reported on the balance sheet—we want to keep a running balance from the beginning of the business. Temporary accounts, also known as nominal accounts, are accounts that track financial transactions and activities over a specific accounting period. These accounts are « temporary » because they start each accounting period with a zero balance and are used to accumulate data for that period only. At the end of the accounting period, the balances in these accounts are transferred to permanent accounts, resetting the temporary accounts to zero for the next period.

Closing Journal Entries Process

Remember that the periodicity principle states that financial statements should cover a defined period of time, generally one year. If we do not close out the balances in the revenue and expense accounts, these accounts would continue 11 tips to manage your small business finances to contain the revenue and expense balances from previous years and would violate the periodicity principle. Transferring funds from temporary to permanent accounts also updates your small business retained earnings account.

Here are MacroAuto’s accounting records simplified, using positive numbers for increases and negative numbers for decreases instead of debits and credits in order to save room and to get a higher-level view. To close the drawing account to the capital account, we credit the drawing account and debit the capital account. Debit each revenue account and credit the Income Summary account. The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7.

Assets, liabilities and most equity accounts are permanent accounts. Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account. The income summary account is then closed to the retained earnings account. Now that the journal entries are prepared and posted, you are almost ready to start next year. Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries.

Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Our T-account for Retained Earnings now has the desired balance. The balance in Retained Earnings was $8,200 before completing the Statement of Retained Earnings.

The accounts that need to start with a clean or $0 balance goinginto the next accounting period are revenue, income, and anydividends from January 2019. To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019. The closing journal entries example comprises of opening and closing balances. Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc. The trial balance above only has one revenue account, Landscaping Revenue.

Income Summary allows us to ensure that all revenue and expense accounts have been closed. The first is to close all of the temporary accounts in order to start with zero balances for the next year. The second is to update the balance in Retained Earnings to agree to the Statement of Retained Earnings. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter.

The following video summarizes how to prepare closing entries. Net income is the portion of gross income that’s left over after all expenses have been met. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Closing the dividends or withdrawals account to Retained Earnings. The balance of the Income Summary account is transferred to the Retained Earnings account.

This account is a temporary equity account that does not appear on the trial balance or any of the financial statements. What did we do with net income when preparing the financial statements? We added it to Retained Earnings on the Statement of Retained Earnings. To add something to Retained Earnings, which is an equity account with a normal credit balance, we would credit the account. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period.

Laisser un commentaire